More Information

ON-LINE ONLY REAL ESTATE AUCTION

PATASKALA TRI-LEVEL

ESTATE OF NORMA JEAN NIXON

LICKING COUNTY CASE # 20250081

6953 Taylor Rd. SW

Reynoldsburg, OH 43068

AUCTION DATE : Thursday, July 24, 2025 @ 11:00 AM

OPEN INSPECTION: Sunday, July 20, 2025 from 1:00-1:30 PM

Licking County Parcel ID: 063-148164-00.000

Annual Property Taxes: $ 4,035

Description

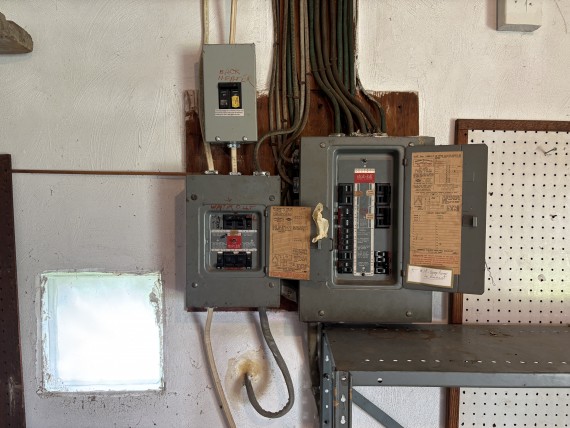

This home features 2,030 sq. ft. of living space. Built in 1967, the home features 3 bedrooms, 2 full bathrooms, a large screen porch and a partial unfinished basement. There is a two car attached garage, a storage shed, all situated on a large corner lot. The home is in need of some repair and updating.

Auction Terms: Sells subject to seller confirmation on auction day. A 10%, non refundable deposit is to be collected from the winning bidder at the conclusion of the auction by direct deposit into our JPmorgan Chase trust account or via credit card payment with a 4% surcharge. Contract signature and deposit must be made by 5 PM the day of Auction. The real estate is sold As Is with no contingencies. All inspections must be done prior to Auction. Close on or before August 24, 2025. Occupancy will be given at closing. A 10% buyer's premium will be added to the high bid to obtain the final contract selling price. Short tax proration. Buyer pays all closing costs. General warranty deed given at closing with no liens or back taxes.

Deposit and Closing:. Transaction must close on or before August 24, 2025 with Ohio Title Corp. Contact Tracy Furyes at tfuryes@ohiotitlecorp.com, for closing cost estimate.

Auctioneer: Ron Denney, CAI

(937) 572-4468

ron@rondenney.com

Broker: Ohio Real Estate Auctions, LLC

Realtor Participation: Realtor cooperation is encouraged. For compensation instructions, please contact the Auctioneer. The requirements are outlined below:

To collect a commission, Realtor's must:

1) Attend one of the open inspections with your client.

2) Register your bidder no less than 48 hours prior to the auction by sending a signed Ohio Agency Disclosure form to the Auctioneer.

3)You will receive 1% of the high bid amount at closing, if you represent the winning bidder.

Disclaimer: Information contained herein and in the Property Information Packet was obtained from sources deemed reliable. However, neither Ohio Real Estate Auctions, LLC Auctioneers nor their agents will be responsible for any errors or omissions regarding information provided by same. Buyers should carefully verify all information and make their own decision as to the accuracy thereof before relying on same.

Annual Taxes: $ 4,035

Property Map

Basic Terms:

Real Estate sells subject to seller confirmation. A 10% Non-Refundable deposit will be collected from the winning bidder the day of Auction no later than 5pm. Deposit instructions will be given to the winning bidder. The real estate is sold As Is with no contingencies. All inspections must be done prior to Auction. Close within 30 days. A 10% buyer's premium will be added to the high bid to obtain the final contract selling price. Short tax proration. The Buyer pays all closing costs. A marketable, insurable deed will be given at closing with no liens or back taxes.

Deposit and Closing:

Buyer will close on or before August 24, 2025 with Ohio Title Corp. Contact Tracy Furyes at (440)772-0942 for a closing cost estimate.

Realtor Participation:

Realtor showings and cooperation are encouraged.For full compensation instructions, see Realtor Registration form attachment. Please call Auctioneer to schedule all showings.